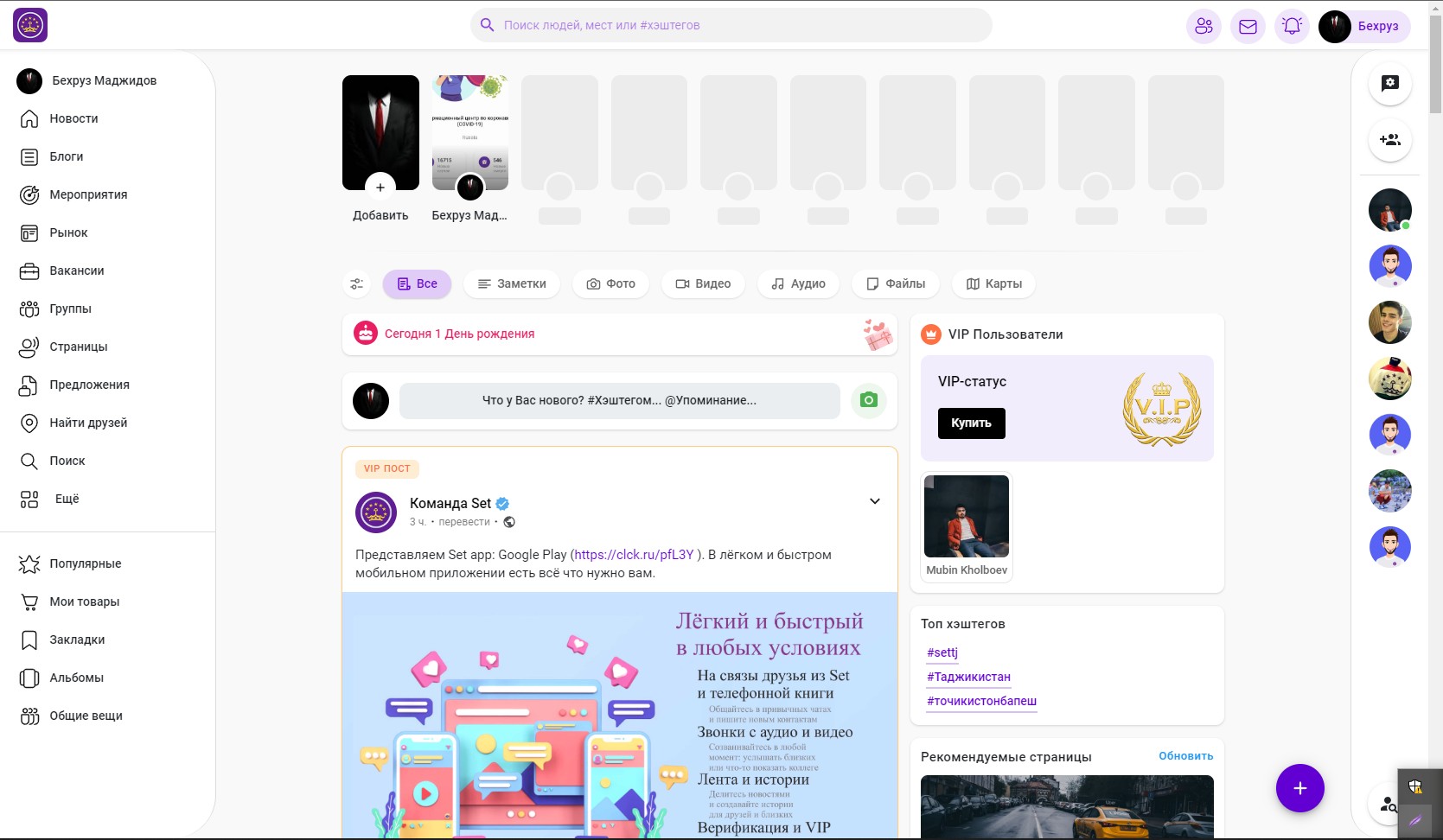

Discover postsExplore captivating content and diverse perspectives on our Discover page. Uncover fresh ideas and engage in meaningful conversations

Installation WoWonder website installation mobile application installation plugins adding new features to your site creating new plugins or changing the design of your site write to us contacts:

📱 WhatsApp: +992880809114

💬 Telegram: https://t.me/behamadjidov

📘 Facebook: https://www.facebook.com/settjk

#seo #developer_dev #socialmedia #elovebook_social

https://wowonder.fra1.cdn.digi....taloceanspaces.com/u

Installation WoWonder website installation mobile application installation plugins adding new features to your site creating new plugins or changing the design of your site write to us contacts:

📱 WhatsApp: +992880809114

💬 Telegram: https://t.me/behamadjidov

📘 Facebook: https://www.facebook.com/settjk

#seo #developer_dev #socialmedia #elovebook_social

https://wowonder.fra1.cdn.digi....taloceanspaces.com/u

Installation WoWonder website installation mobile application installation plugins adding new features to your site creating new plugins or changing the design of your site write to us contacts:

📱 WhatsApp: +992880809114

💬 Telegram: https://t.me/behamadjidov

📘 Facebook: https://www.facebook.com/settjk

#seo #developer_dev #socialmedia #elovebook_social

https://wowonder.fra1.cdn.digi....taloceanspaces.com/u

Installation WoWonder website installation mobile application installation plugins adding new features to your site creating new plugins or changing the design of your site write to us contacts:

📱 WhatsApp: +992880809114

💬 Telegram: https://t.me/behamadjidov

📘 Facebook: https://www.facebook.com/settjk

#seo #developer_dev #socialmedia #elovebook_social

https://wowonder.fra1.cdn.digi....taloceanspaces.com/u